4 June 2025

Financial Literacy for Small Business Owners: What You Should Know

Financial literacy is more than just a buzzword—it’s an essential skill for every small business owner in Vancouver. From managing cash flow to understanding taxes and payroll, strong financial foundations help you make smarter decisions and plan for long-term success. Whether you’re launching your first startup or managing a growing business, this guide outlines what you need to know—and what to do next.

Why Financial Literacy Matters

- Cash flow issues that affect daily operations

- Poor budgeting leading to overspending or underinvestment

- Missed tax deadlines and CRA penalties

- Inefficient payroll and bookkeeping systems

Building financial literacy gives you control and confidence. Check out our bookkeeping services if you want expert support with your numbers.

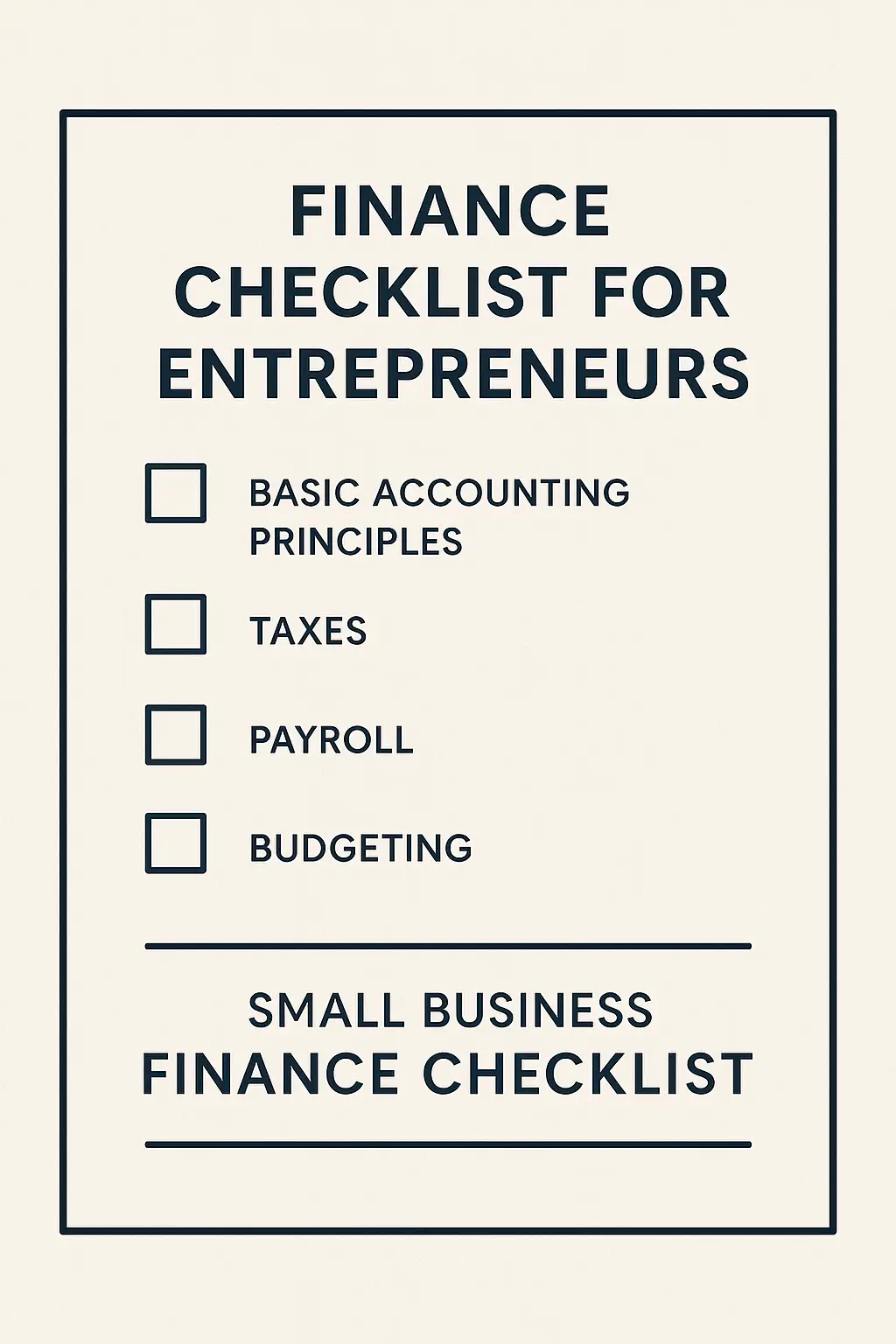

Key Areas to Focus On

- Basic Accounting Principles: Learn how to read a balance sheet, income statement, and cash flow report.

- Taxes: Know when and how to file GST/HST, PST, and annual returns. Our Tax Preparation Services can help.

- Payroll: Understand remittance schedules, T4 reporting, and deductions. Learn more in our article Avoiding Common Payroll Errors.

- Budgeting: Learn how to build and follow a business budget. Read our guide on Creating a Business Budget That Actually Works.

Free Download: Small Business Finance Checklist

We’ve prepared a simple, printable checklist to help you stay on top of your business finances month-by-month.

Download the Small Business Finance Checklist to stay organized year-round.

Get Professional Support

If all this feels overwhelming, you’re not alone. That’s where working with a CPA helps. Judi Wang, CPA offers expert accounting and advisory services tailored to small business owners in the Vancouver area. Whether you need help with planning, compliance, or automation, we’re here to support your goals.

For related insights, also read:

Take the Next Step

Improving your financial literacy is one of the smartest investments you can make in your business. Schedule an appointment with us today to get personalized guidance—or contact our office with your questions.