29 May 2025

Creating a Business Budget That Actually Works: Step-by-Step Guide

Creating a Business Budget That Actually Works: Step-by-Step Guide

Building a business budget that supports growth and minimizes risk is a key part of financial success. Many Vancouver entrepreneurs struggle to forecast income and expenses accurately. This step-by-step guide simplifies the process and helps you take control of your finances.

Discover how our Business Accounting Services can support your planning process.

Step 1: Set Realistic Financial Goals

- Outline short-term and long-term business objectives.

- Break down financial targets into monthly or quarterly segments.

Having defined goals helps guide spending decisions. Learn more about Effective Budgeting Techniques.

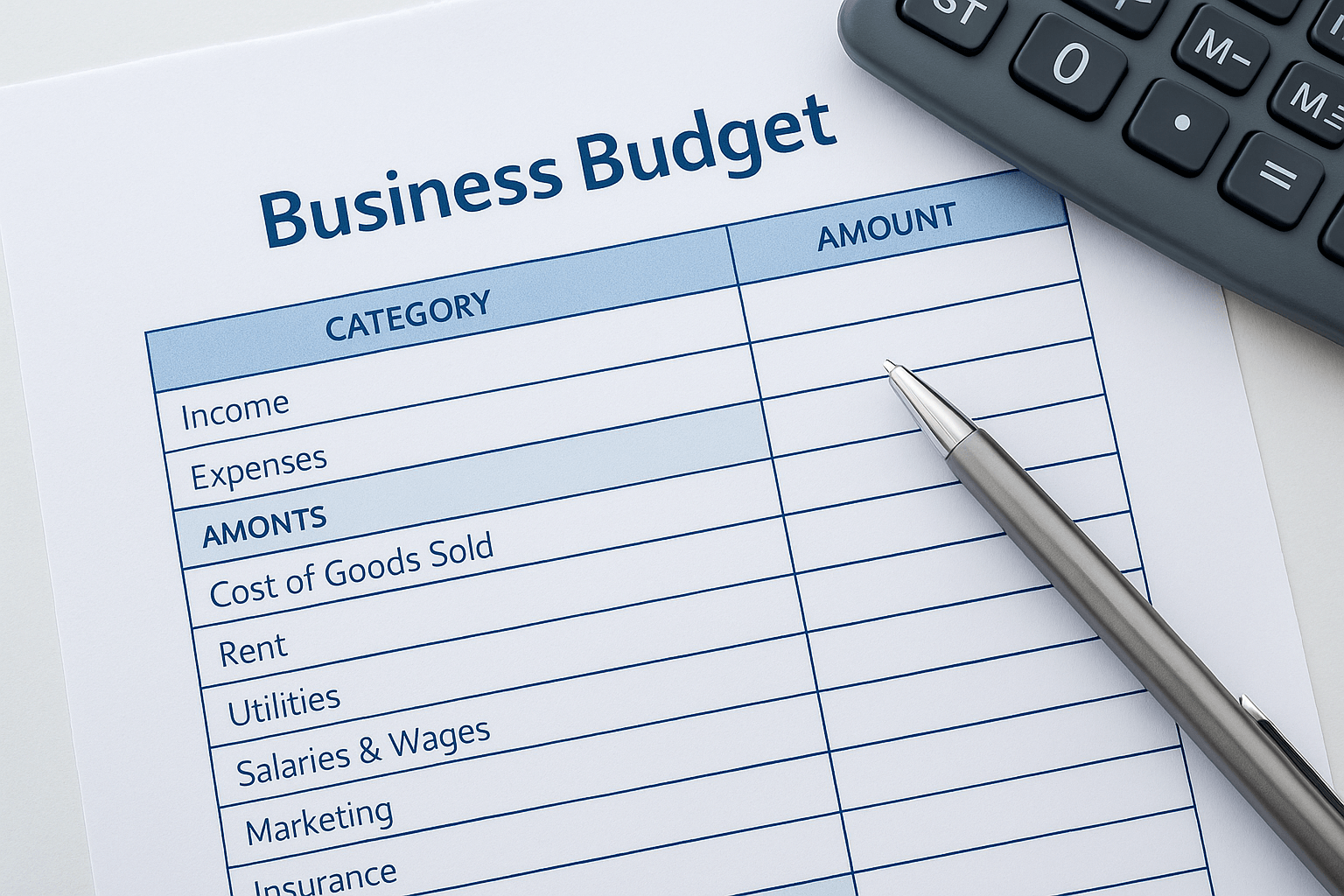

Step 2: Estimate Revenue and Fixed Expenses

Start by calculating your average monthly income from product sales or services. Then add up all fixed costs such as rent, utilities, software subscriptions, and insurance. This will give you a foundation for budget planning.

We can help you forecast these figures with our Tax Planning Services.

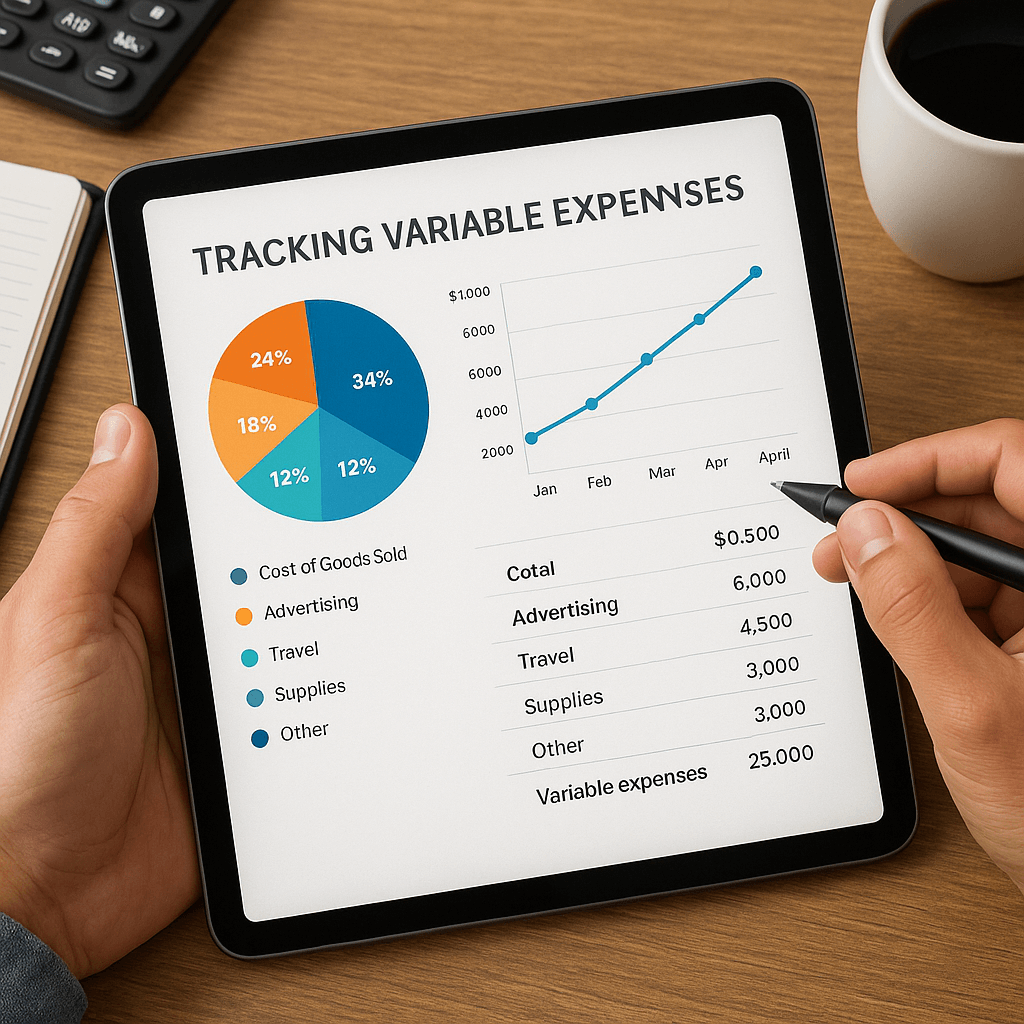

Step 3: Track Variable Expenses

Account for marketing, travel, seasonal costs, and inventory purchases that may fluctuate. Use past records to estimate average monthly values. Consider automation to streamline tracking through our Bookkeeping Services.

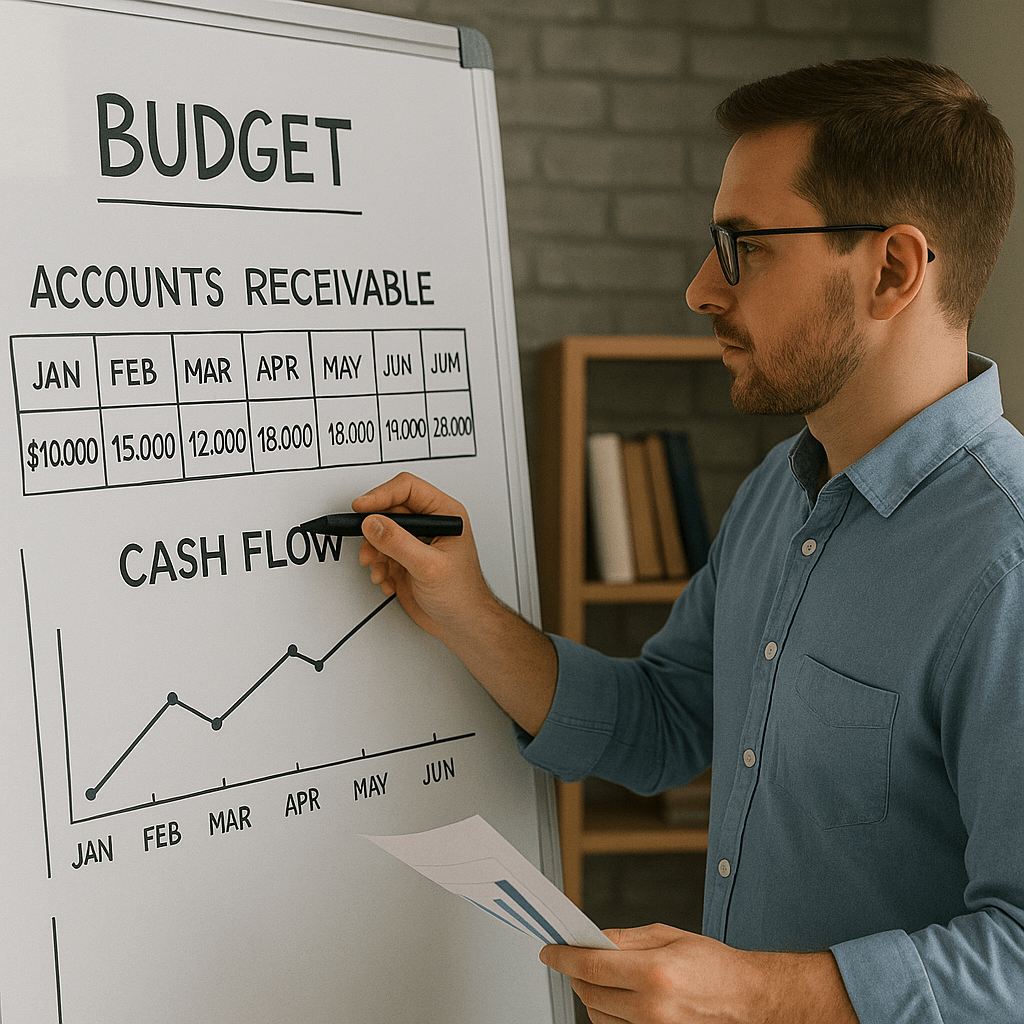

Step 4: Adjust for Cash Flow Timing

Make sure your budget reflects when cash is actually received or spent. Accounts receivable and delayed invoices can impact your liquidity, even when profit looks strong on paper.

We cover this in more detail in our article Understanding Financial Statements.

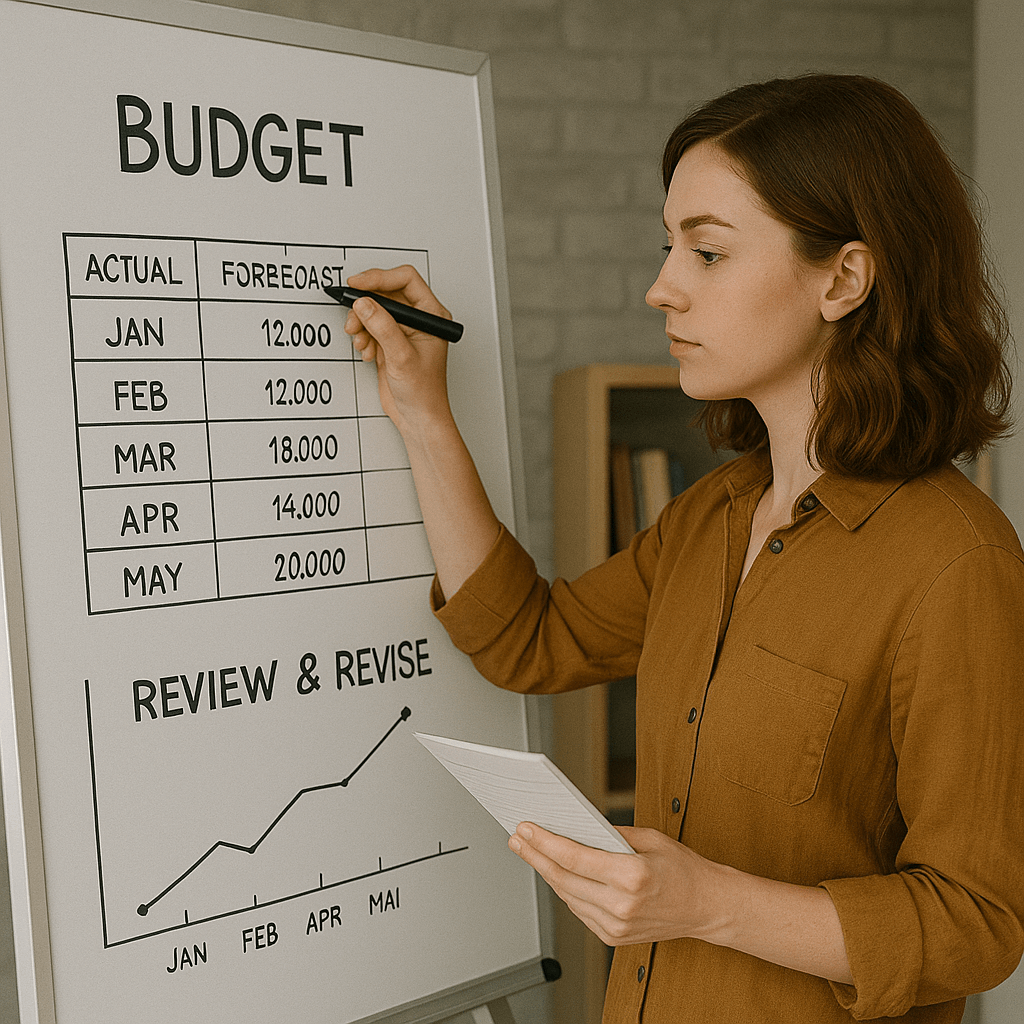

Step 5: Review and Revise Monthly

Your budget should be a living document. Schedule monthly check-ins to compare actual performance against your forecast and adjust accordingly. This keeps you aligned with your goals and responsive to market changes.

Need Help Creating a Budget That Works?

Let Judi Wang, CPA guide your business through smarter financial planning and forecasting. Get expert help tailored to your needs.