2 July 2025

Creating a Business Budget That Actually Works: Step-by-Step Guide

Creating a realistic and actionable business budget is crucial for small business owners who want to thrive in Vancouver’s dynamic economy. Whether you’re launching a startup or refining the finances of an established company, budgeting helps you understand your cash flow, reduce financial stress, and meet long-term goals.

Why Budgeting Matters

For businesses of any size, budgeting serves as a financial roadmap. It provides structure for spending and saving, and offers insight into financial performance. For small business owners, this means:

- Better financial control – Anticipate cash shortages or surpluses

- Smarter decision-making – Base strategic choices on solid numbers

- Improved funding chances – Show lenders and investors your business is financially sound

Check out our Financial Reporting & Compilation Services to strengthen your documentation.

Step-by-Step Guide to Building a Business Budget

1. Identify All Revenue Sources

Start by listing all expected income streams, including product sales, services, investment returns, and grants. Use data from prior periods when possible. If you’re forecasting for a new business, be conservative with your estimates.

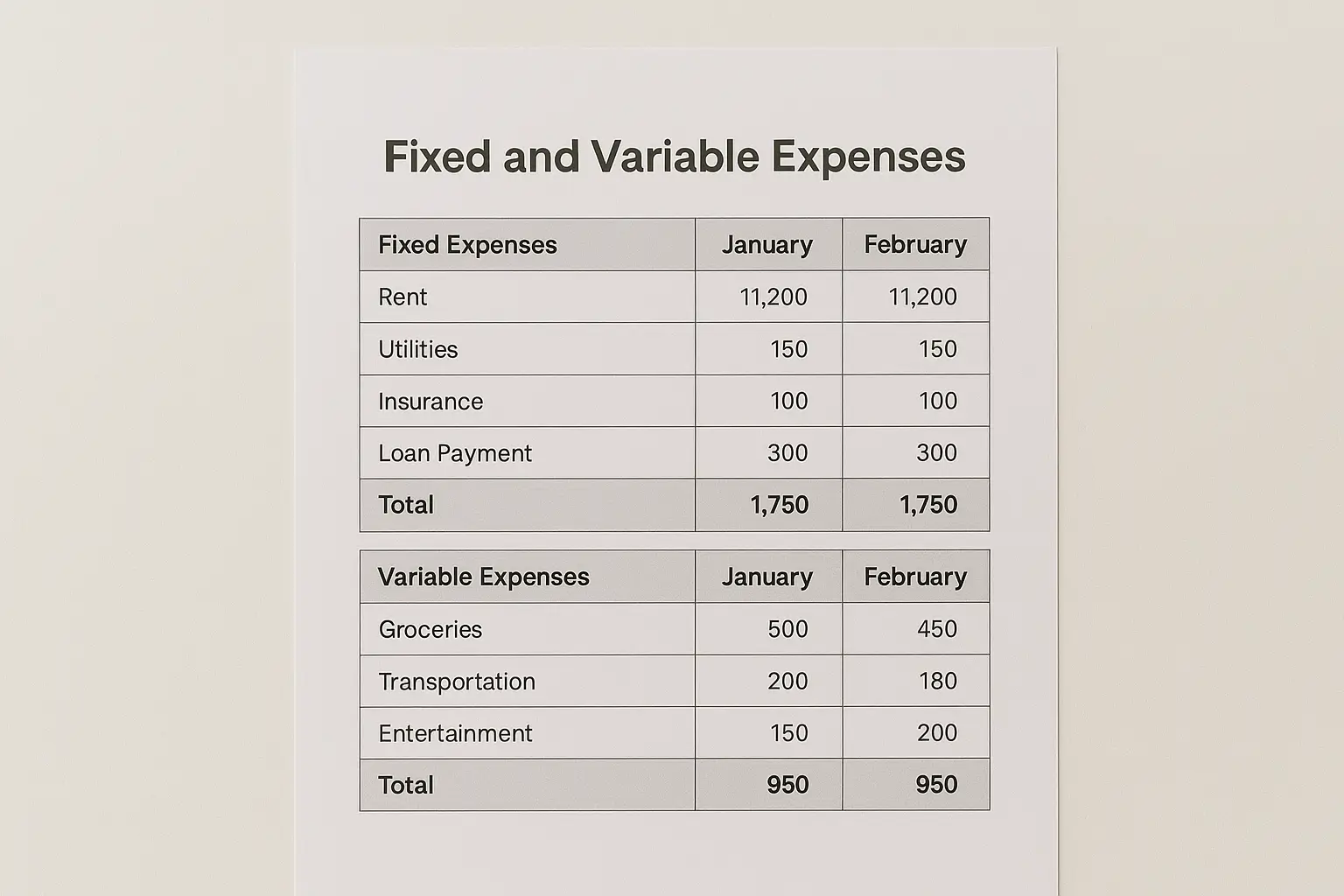

2. Categorize Fixed and Variable Expenses

Fixed costs stay constant regardless of output—like rent, insurance, or salaries. Variable costs change based on activity level, like utilities, raw materials, and commissions. Having a clear view of these will help you adjust in lean periods.

3. Determine One-Time and Seasonal Expenses

Don’t forget to include occasional costs—such as software renewals, equipment upgrades, or seasonal marketing. Budgeting for these in advance helps you avoid cash flow crunches.

4. Forecast Cash Flow

Understanding when money comes in and when it goes out is essential for staying solvent. Use your budget to forecast monthly cash flow. Include expected timelines for payments and receivables.

Learn how to leverage your financial data for business growth through forecasting.

5. Set Financial Goals

Establish both short- and long-term financial targets—whether it’s reducing debt, expanding operations, or hiring staff. Use your budget to measure progress toward these goals.

6. Plan for Contingencies

Unexpected events can derail even the most well-planned budgets. Build a buffer or contingency fund to cover surprises like emergency repairs or sudden dips in revenue.

7. Review and Adjust Regularly

Your business isn’t static—and your budget shouldn’t be either. Review your budget monthly or quarterly to update projections based on real-world data.

Need help staying on track? Our Advisory Services offer ongoing support to help you pivot when needed.

Common Budgeting Mistakes to Avoid

- Overestimating income – Be realistic, especially with projections

- Ignoring seasonal patterns – Account for slow and peak periods

- Forgetting taxes – Set aside funds for GST/HST, PST, and payroll taxes

For assistance with tax planning and preparation, visit our Tax Services page.

Tools for Budgeting Success

Using accounting software or spreadsheets is essential for accuracy. Consider tools like QuickBooks, Wave, or Xero, especially when paired with professional advice.

Get expert assistance through our Bookkeeping Services to help manage and track your expenses efficiently.

Downloadable Budget Template

To make things even easier, we’ve created a Free Business Budget Template for you to download and customize. Stay tuned—this feature is coming soon to our Downloadable Content page.

If you want expert help building a business budget that truly works for you, schedule an appointment with us today. Or contact our team for more personalized guidance.

Looking for more advice? Explore the article Effective Budgeting Techniques for Small Businesses to dive deeper.

Focus Key Phrase: business budgeting Vancouver, small business finances, CPA tips