2 July 2025

CRA Audit Triggers: What to Avoid in 2025

As a small business owner in Vancouver, understanding how to stay off the Canada Revenue Agency’s (CRA) audit radar in 2025 is essential for your financial stability and peace of mind. With the CRA increasing its scrutiny in key areas such as digital transactions, foreign income, and expense claims, it’s more important than ever to be proactive. This article will help you identify common CRA audit triggers and share practical ways to avoid them.

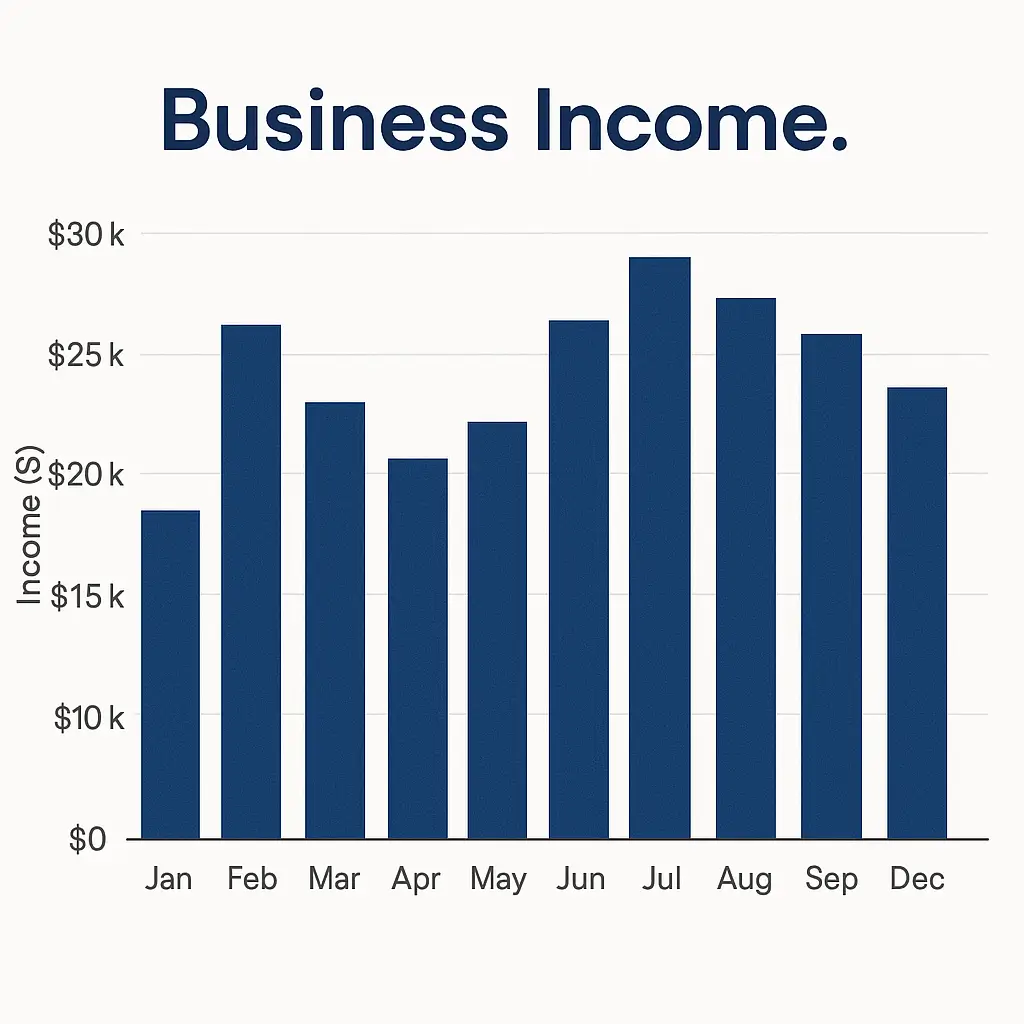

1. Unusual Changes in Income or Expenses

Significant fluctuations in your income or expenses from one year to the next can raise red flags. While legitimate, such changes require careful documentation and explanation.

- Keep detailed records of why there was a spike or drop in revenue.

- Include explanatory notes with your return if large changes are present.

Related article: Creating a Business Budget That Actually Works

2. High Expense Claims

Overstating expenses is one of the most common reasons for a CRA audit. If your expense-to-income ratio is much higher than the industry average, it could raise suspicion.

- Use accounting software to categorize and track expenses accurately.

- Separate business and personal expenses clearly.

- Work with a qualified CPA to ensure compliance.

Related post: Small Business Expenses You Can Actually Claim

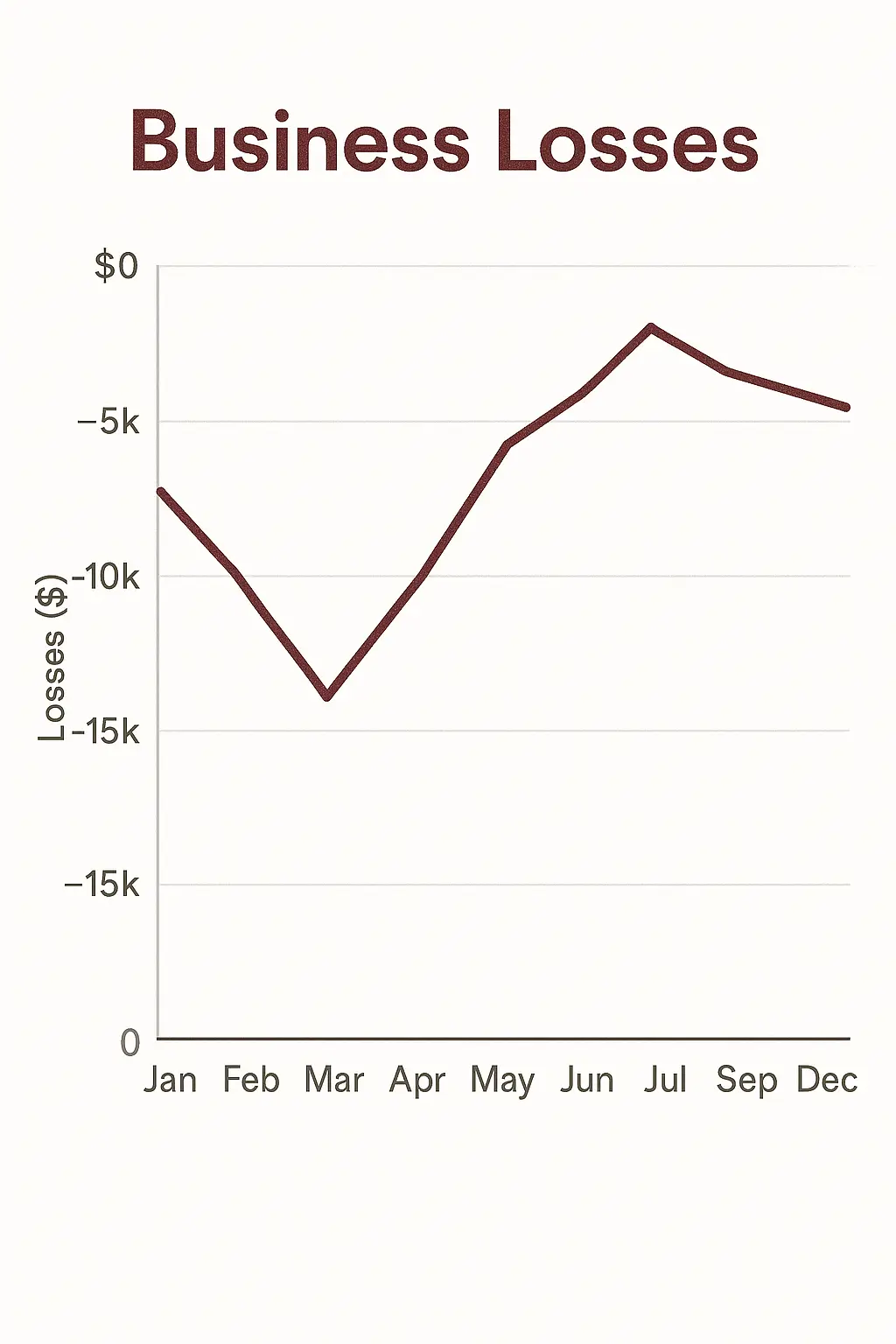

3. Consistently Reporting Business Losses

Reporting losses year after year may lead the CRA to believe your business is a hobby rather than a legitimate enterprise. This is especially true for side businesses and startups.

- Keep a business plan showing your path to profitability.

- Track progress and note improvements annually.

Explore more: Maximizing Business Deductions in Canada

4. Home Office and Vehicle Use Deductions

These deductions are allowed, but overestimating their usage can draw attention. The CRA expects deductions to be reasonable and proportional.

- Maintain mileage logs for vehicle use.

- Measure and document the square footage of your home office.

See: Top 5 Common Issues with Bookkeeping and Tax

5. Payroll and GST/HST Filing Errors

Inaccurate payroll submissions or missed GST/HST filings are red flags. Small business owners should ensure they meet all CRA deadlines and report accurately.

- Use professional payroll services for accuracy.

- Regularly review GST/HST submissions with your accountant.

6. Large Charitable Donations or International Transactions

While legitimate, these can attract extra scrutiny. Always keep receipts and documentation to support large donations or foreign income.

Useful article: Year-End Tax Checklist for Small Businesses

Work with a Vancouver CPA to Avoid Audit Triggers

Working with an experienced Vancouver CPA firm like Judi Wang, CPA, CGA can significantly reduce your audit risk. Our team provides expert guidance in tax planning and preparation, bookkeeping, and CRA correspondence support.

Final Thoughts: Staying organized, documenting everything, and working with professionals is your best defense against a CRA audit. Knowing what triggers an audit and how to mitigate risks helps you focus on growing your business rather than dealing with tax issues.

Ready to protect your business from CRA scrutiny? Schedule an appointment with our experts or contact us to learn more.